how to pass on generational wealth

Tier 1 daily balance up to 9999 Tier 2. This kind of wealth transfer isnt limited to parents and children.

Looking For A Solution Business Inspiration Quotes Great Motivational Quotes Life Quotes Deep

In fact the average millionaire has seven streams of income.

. The goal of generational wealth is to pass it down without erosion. You can prevent this from happening by protecting your wealth plus any future wealth generated by implementing an iron-clad estate plan and. One of the most important steps you can take when building generational wealth is educating your children.

If they do not want to work in the family business you have still created an option for them by. Dividend rates are based on the account balance and account tier. Generally most people invest for 30 to 35 years before needing to use the money for retirement.

A key step in building generational wealth is to create an estate plan which will ensure that in the event of death or incapacitation your assets would be divided according to your wishes. If you think of it that way you will lose it. We use the daily balance method to calculate the dividend on your account.

Teaching your children the basics of personal finances can help them create good personal financial habits. How can you pass on generational wealth. Examples of generational wealth could include a parent teaching their child about budgeting.

I use Personal Capital to track my net worth for free. For example you need to have a net worth of 45 million in the US. You can train them to do well then put the business in.

The accounts are available to you depend on your insurer or broker. How to Pass on Generational Wealth. Generational wealth is a concept that more and more individuals and families are thinking about.

Create multiple streams of income. There are a variety of income streams but one of the best is known as passive income. When we say you need a mentor we dont mean a.

There are lots of ways to pass down your wealth. Generational wealth refers to the passing of assets from one generation to another. The amount I would consider generational wealth would be at least ten times the top 1 net worth in your location.

Event to offer insights on financial health path to homeownership and entrepreneurship. Investing in real estate is another great way to build wealth that lasts for generations. Articulating your vision for the future and getting buy-in from your family.

VARIABLE LIFE INSURANCE. If you do this the additional funds you make can help you build wealth and the impact will be monumental for future generations. Luke Skywalker had Obi-Wan Kenobi Spider-Man had Iron Man.

Here are some examples. Variable insurance policies grow cash value based on the performance of market-based accounts like equities bonds or money market accounts. Investing in real estate is just one of many ways to build generational wealth which can take many shapes.

Building generational wealth can be done in a. It could take the form of financial advice from a successful uncle. First it allows you to begin with a higher amount to invest.

There are several steps that one can take to pass down generational wealth. If you put in the initial effort and pay off the mortgage real estate will offer steady and reliable cash flow for generations to come. Building family wealth is no easy task but when it goes well it can be compounded with each passing generation.

Generational wealth allows you to take the concept of compounding interest and expand it by doing two things. But before we get there lets go through the top five steps you should take to get started building generational wealth. You can give it while youre alive.

The largest wealth transfer in history is taking place right now with an estimated 30 trillion being passed on from Baby Boomers to their childrenPlus the tech and crypto boom has helped many in their 30s and 40s explore the concept. When it comes to how to build generational wealth creating multiple streams of income can make it easier. The tiers are as follows.

You can give it through your will. Generational wealth is money or assets that you accumulate and pass down to future generations. At its core generational wealth is wealth that you can pass down to future generations.

The obvious way is to give your wealth upon your death. To be in the top 1 and the number jumps to 8 million if you live in Monaco. There isnt a single best way to accumulate it and well show you some of the most popular ways to gain a lot of it.

It could be helping your teenager buy a car or make a downpayment on a home later in life. Second it allows the money to grow even longer. The Bottom Line on Generational Wealth.

Your cash value can be invested in these accounts and your wealth grows when the accounts do well. Here are a few. Although assets may pass on by inheritance after ones death a trust allows them to be transferred when the owner is still alive.

To wrap up the success or failure of a generational plan rests on three things. Start By Educating Your Children. Allowing your children to understand budgeting managing debt and the process of saving money.

Depending on your goals here are four options to pass on generational wealth. Data shows that generational wealth is easy to lose so much so that most families lose their wealth within two or three generations. This is particularly useful when youre giving something like a business.

Anything you can pass down to your children or grandchildren that generates money or constitutes money can be considered. Ad Browse Discover Thousands of Business Investing Book Titles for Less. Even when saving for retirement you can begin creating generational wealth.

To earn dividends you must maintain a minimum balance of 100. So building a business to pass down to your children is another way to build generational wealth. You should consistently utilize the cash from your side-hustle as an important part of your greater financial plan and invest it in your goals.

Saving money is one way to build generational wealth because even if youre in debt today saving a little bit every month will add up over time and create an opportunity for future generations to be able to inherit a substantial sum of money when they reach adulthood. Invest in real estate. There are different ways to create and pass down generational wealth while youre alive and you can also set up your estate to continue your legacy after you pass.

To reach your generational-wealth-building goals youll need to find a mentor of your own. JPMorgan Chase is hosting a full day of conversations and informational sessions to support financial health education wealth-building and financial inclusion for New Orleans Black community as part of its three-city Advancing Black Wealth Tour.

The Flip Side Of Generational Wealth Wealth Quotes Wealth Vision Board Uplifting Quotes

How To Build Generational Wealth Finance Lessons Wealth Personal Finance

Pin On Investing And Creating Wealth

One Must Be A Mogul And Create Generational Wealth Wealth Affirmations Wealth Quotes Fabulous Quotes

The Link Between Participation Trophies And Financial Failure Arrest Your Debt Wealth Transfer Money Advice Personal Finance Bloggers

A Young Family S Roadmap To Building Generational Wealth Family Money Family Finance Finance Debt

Generational Wealth How To Leave A Lifetime Legacy Paradigmlife Net Blog Life Insurance Policy Wealth Transfer Life Insurance Companies

Generational Wealth Black Economics Black Economic Empowerment Finance

How To Build Generational Wealth Life Insurance Life Insurance Companies Life Insurance Policy

Pin On Manage Your Money Better

Generational Wealth Wealth Quotes Money Mindset Wealth

Moneyvalue Creating Generational Wealth Life Insurance Quotes Term Life Insurance Quotes Wealth

Pin On Building Generational Wealth

Quotes Wisdom Life Deep Wealth Risk Success Money Work Hustle Ambition Rich Today Quotes Risk Quotes Inspirational Quotes Motivation

Success Diaries On Instagram Follow My Other Page Successjournal The Goal Isn T Wealth Quotes Inspiring Quotes About Life Motivational Quotes For Success

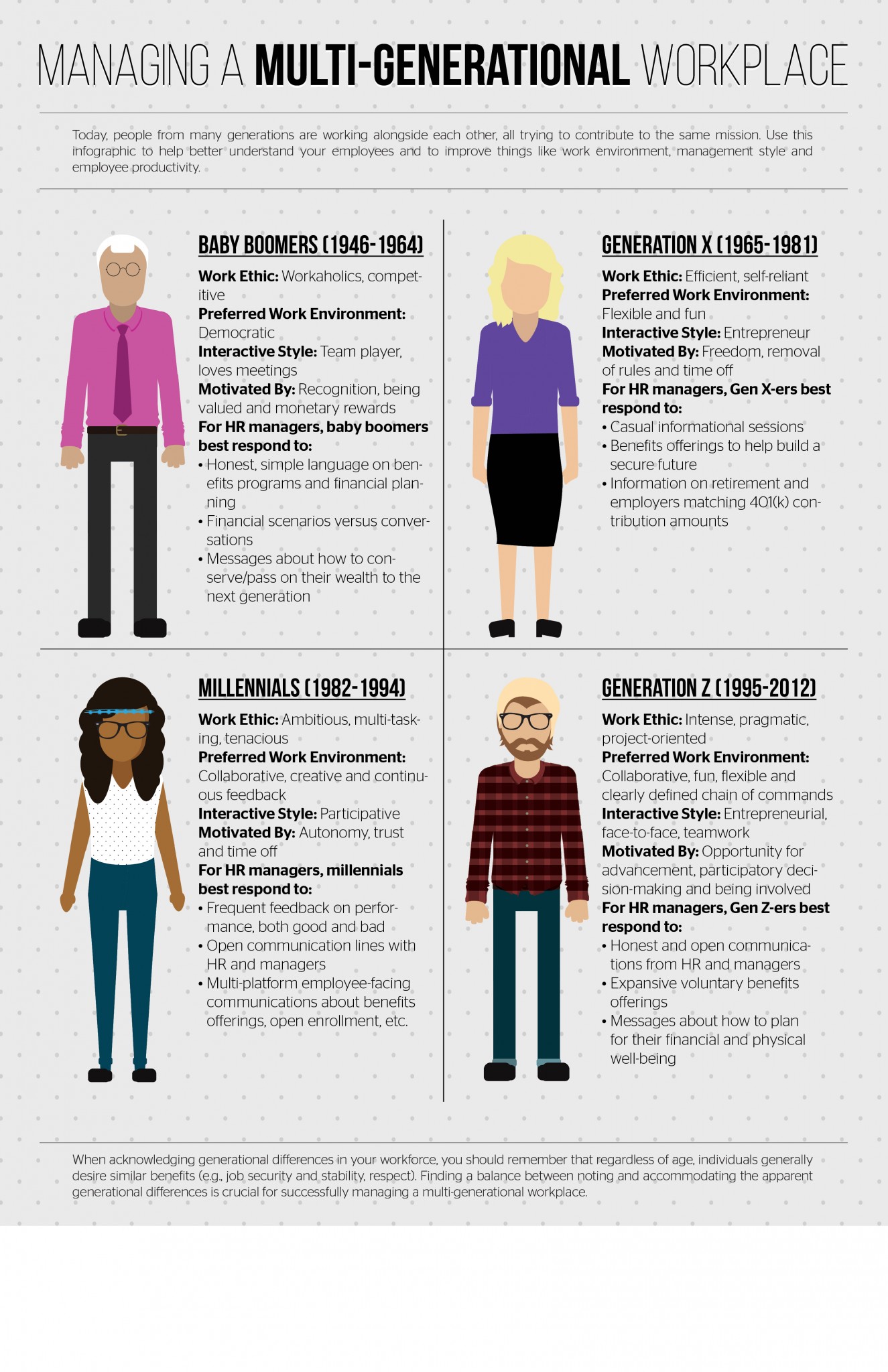

Management In A Multi Generational Workplace Leadership Business Hr Generations In The Workplace Multi Generational Workplace

Generational Wealth What It Is Why It Matters And How To Build It Partners In Fire Personal Finance Blogs Life Insurance Quotes Wealth